How Can I Talk to Someone at the IRS? Navigating the IRS Phone System and Other Options

Dealing with the IRS can be daunting, especially when you need immediate assistance. Getting through to a live representative can feel like searching for a needle in a haystack. This guide will walk you through the various ways to contact the IRS, helping you choose the most effective method for your situation.

Understanding the IRS Contact Options

The IRS offers several ways to reach them, each with its own pros and cons:

1. The IRS Phone System: A Detailed Breakdown

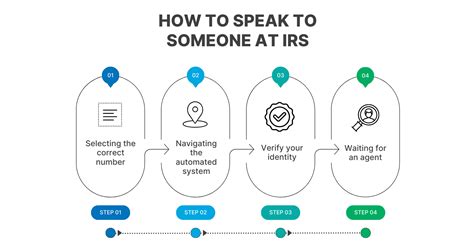

This is often the first option people try, but it's notoriously difficult to navigate. Here's what you need to know:

- Long Wait Times: Be prepared for extended hold times, sometimes exceeding an hour. The busiest times are typically tax season (January to April).

- Automated System: You'll likely interact with an automated system before reaching a representative. Listen carefully to the prompts and have your information ready (Social Security number, tax year, etc.).

- Specific Issues: The automated system will often direct you to a specific department based on your needs. Knowing your specific issue beforehand can save you time.

- IRS.gov Website: Before calling, check the IRS website. Many questions can be answered online, saving you the trouble of a long phone call.

2. The IRS.gov Website: A Wealth of Information

The IRS website is a treasure trove of information. You can:

- Find Answers to Frequently Asked Questions (FAQs): The website contains a comprehensive FAQ section addressing common tax-related issues.

- Download Forms and Publications: Access and download various tax forms, instructions, and publications directly from the site.

- Manage Your Account: Use the IRS' online tools to track your refund, view your tax account transcript, and make payments.

- IRS2Go Mobile App: The IRS2Go mobile app allows you to access many of the same features as the website, making it easier to manage your tax information on the go.

3. Taxpayer Advocate Service (TAS): For Complex Issues

If you're facing significant problems with the IRS, such as prolonged delays, unresponsive staff, or complex tax issues, the Taxpayer Advocate Service can help. TAS is an independent organization within the IRS dedicated to resolving taxpayer issues. They can advocate on your behalf and help you navigate bureaucratic hurdles.

4. Mail: A Slower but Reliable Option

Sending a letter to the IRS might seem old-fashioned, but it can be a surprisingly effective method for certain situations. Make sure to include all necessary information, such as your Social Security number, tax year, and a clear explanation of your issue. Keep a copy of the letter and proof of mailing for your records.

Tips for Successfully Contacting the IRS

- Be Prepared: Gather all relevant information, including your Social Security number, tax year, and the specific issue you're facing.

- Call During Off-Peak Hours: Try calling early in the morning or late in the afternoon to avoid the busiest times.

- Be Patient: Remember that wait times can be long. Stay calm and persistent.

- Use the Right Channel: Choose the most appropriate method based on your issue (website for FAQs, TAS for complex issues, phone for urgent matters).

Conclusion: Finding the Right Path to IRS Assistance

Successfully contacting the IRS requires strategy and patience. By utilizing the resources outlined above and employing the tips provided, you'll significantly increase your chances of resolving your tax-related issues efficiently. Remember to always verify information found online with official IRS sources.