How To Calculate Retained Earnings: A Simple Guide

Understanding retained earnings is crucial for anyone analyzing a company's financial health. Retained earnings represent the cumulative profits a company has earned over its lifetime that haven't been distributed as dividends to shareholders. This figure provides valuable insight into a company's ability to reinvest in its growth and future profitability. This guide will walk you through how to calculate retained earnings, explaining the formula and offering practical examples.

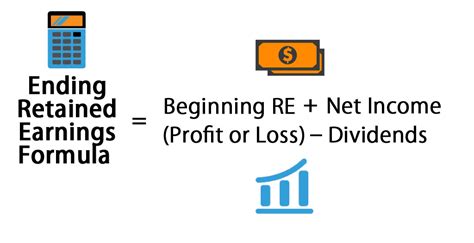

Understanding the Retained Earnings Formula

The fundamental formula for calculating retained earnings is surprisingly straightforward:

Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings

Let's break down each component:

-

Beginning Retained Earnings: This is the retained earnings balance at the start of the accounting period (usually a year). It's the ending retained earnings from the previous period.

-

Net Income: This represents the company's profit after deducting all expenses from its revenues during the accounting period. A net loss would be subtracted instead.

-

Dividends: These are payments made to shareholders from the company's profits. They reduce the amount of retained earnings.

-

Ending Retained Earnings: This is the final retained earnings balance at the end of the accounting period. This is the figure you're ultimately calculating.

Step-by-Step Calculation: A Practical Example

Let's illustrate the calculation with a hypothetical example:

Imagine "Acme Corporation" started the year with $50,000 in retained earnings. During the year, they generated a $20,000 net income and paid out $5,000 in dividends.

Here's how we calculate their ending retained earnings:

- Beginning Retained Earnings: $50,000

- Net Income: $20,000

- Dividends: $5,000

Calculation: $50,000 + $20,000 - $5,000 = $65,000

Therefore, Acme Corporation's ending retained earnings for the year are $65,000.

Finding the Information You Need

The information needed to calculate retained earnings is typically found on a company's:

- Statement of Retained Earnings: This statement explicitly shows the beginning balance, net income, dividends, and ending balance of retained earnings.

- Income Statement: This statement shows the company's net income or net loss for the period.

- Statement of Cash Flows: While not directly used in the retained earnings calculation, this statement provides insights into dividend payments. The information can be cross-referenced for accuracy.

- Balance Sheet: The balance sheet will show the ending retained earnings for a given period.

Why is Calculating Retained Earnings Important?

Understanding retained earnings is vital for several reasons:

- Assessing Financial Health: High retained earnings suggest a company is profitable and able to reinvest in itself, indicating strong financial health.

- Investment Decisions: Investors often analyze retained earnings to gauge a company's growth potential and long-term viability.

- Creditworthiness: Lenders consider retained earnings as an indicator of a company's ability to repay loans.

- Internal Financial Planning: Companies use retained earnings figures for internal budgeting and financial planning.

Beyond the Basics: Considerations for Accuracy

While the formula is simple, accurate calculation requires attention to detail. Ensure you're using figures from the same accounting period and consider any adjustments or corrections to net income or dividends that might be necessary. Consulting with a financial professional is always recommended for complex situations.

By understanding and applying this simple formula, you gain valuable insights into a company's financial strength and future prospects. Remember to always double-check your figures to ensure accuracy.