How To File For Bankruptcy: A Comprehensive Guide

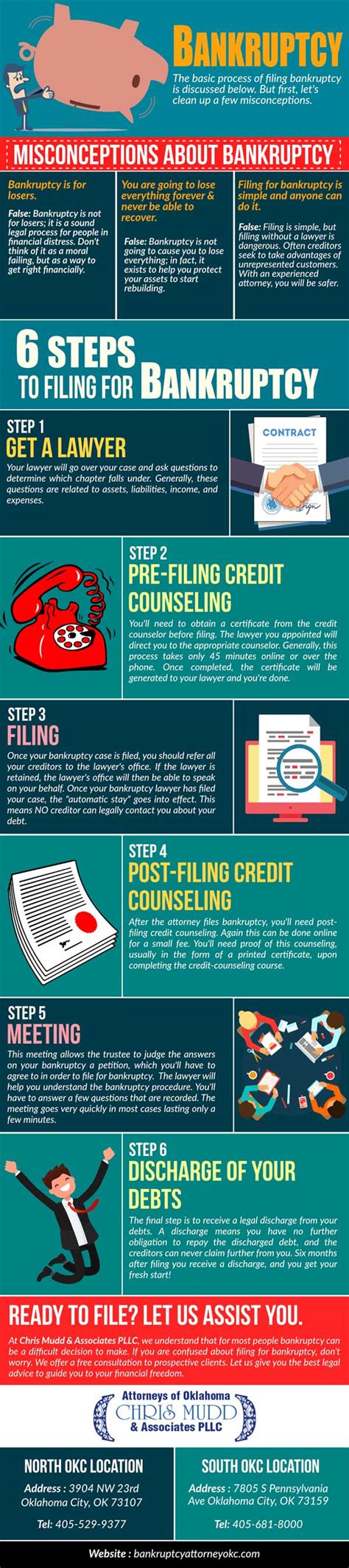

Filing for bankruptcy can feel overwhelming, but understanding the process can ease the burden. This guide provides a comprehensive overview of the steps involved, helping you navigate this complex legal procedure. Remember, this is for informational purposes only and isn't a substitute for professional legal advice. Always consult with a bankruptcy attorney before making any decisions.

Understanding Bankruptcy Chapters

Before diving into the filing process, it's crucial to understand the different types of bankruptcy:

Chapter 7 Bankruptcy (Liquidation)

Chapter 7 bankruptcy involves liquidating non-exempt assets to repay creditors. This means selling off possessions to pay back as much debt as possible. After the liquidation, remaining debts are usually discharged. Eligibility for Chapter 7 depends on your income and assets. A means test is used to determine eligibility.

Chapter 13 Bankruptcy (Reorganization)

Chapter 13 bankruptcy allows individuals with regular income to create a repayment plan over three to five years. This plan involves making regular payments to creditors according to a court-approved schedule. Upon successful completion of the plan, remaining debts are discharged. Chapter 13 is often preferred for those who want to keep their assets.

Steps to Filing for Bankruptcy

The process of filing for bankruptcy involves several key steps:

1. Gathering Necessary Documents

This is a crucial first step. You'll need extensive financial documentation, including:

- Income information: Pay stubs, tax returns, bank statements, etc.

- Debt information: Credit card statements, loan documents, medical bills, etc.

- Asset information: Details on all your property, including real estate, vehicles, and personal possessions.

2. Credit Counseling

Most bankruptcy courts require you to complete credit counseling before filing. This involves attending a course that educates you on budgeting and debt management strategies. The completion certificate will be required as part of your bankruptcy filing.

3. Choosing a Bankruptcy Attorney

Given the complexity of bankruptcy law, seeking legal counsel is strongly recommended. A bankruptcy attorney can guide you through the process, ensuring your rights are protected and your filing is accurate. They can also help you determine which chapter of bankruptcy is best suited for your circumstances.

4. Filing the Bankruptcy Petition

Your attorney will help you prepare and file the necessary paperwork with the bankruptcy court. This includes the petition, schedules listing your assets, liabilities, income, and expenses, and a statement of financial affairs.

5. Meeting of Creditors (341 Meeting)

After filing, you'll attend a meeting of creditors, also known as a 341 meeting. This is a court-supervised meeting where creditors can question you about your finances and the bankruptcy filing.

6. Debt Discharge (Potential)

If you successfully complete the requirements of your chosen bankruptcy chapter (Chapter 7 or Chapter 13), your eligible debts will be discharged. This means you are no longer legally obligated to pay them.

Factors Affecting Your Bankruptcy Case

Several factors can influence the outcome of your bankruptcy case:

- Your Income: Income levels significantly impact your eligibility for Chapter 7.

- Your Assets: The value of your assets determines whether liquidation is necessary under Chapter 7.

- The Type of Debt: Some debts, such as student loans and alimony, may not be dischargeable in bankruptcy.

Alternatives to Bankruptcy

Before considering bankruptcy, explore alternative options, such as debt consolidation, debt management plans, or negotiating with creditors. These options might help you avoid the long-term consequences of bankruptcy.

Disclaimer: This information is for educational purposes only and should not be considered legal advice. Consult with a qualified bankruptcy attorney to discuss your specific situation and determine the best course of action.