How to Look Up Your EIN Number: A Complete Guide

Finding your Employer Identification Number (EIN), also known as a Federal Tax ID Number, can sometimes feel like searching for a needle in a haystack. But don't worry! This comprehensive guide will walk you through several easy ways to locate your EIN, regardless of whether you're a business owner, tax professional, or simply need this number for a specific purpose.

What is an EIN?

Before we dive into how to find your EIN, let's quickly clarify what it is. An EIN is a nine-digit number assigned by the IRS to businesses operating in the United States. It's essentially your business's social security number and is used for various tax-related purposes, including filing taxes, opening business bank accounts, and hiring employees. Knowing where to find your EIN is crucial for smooth business operations.

Where to Find Your EIN Number: Proven Methods

Here are several reliable ways to locate your EIN, ranging from quick checks to more formal retrieval methods.

1. Check Previous Tax Documents

The easiest and most likely place to find your EIN is on previous tax returns you've filed. Look for documents like:

- Form 1040: If you're a sole proprietor, your EIN might be on your personal income tax return.

- Form 1065: For partnerships.

- Form 1120: For corporations.

- Form 990: For non-profit organizations.

Thoroughly review these documents; the EIN is typically prominently displayed.

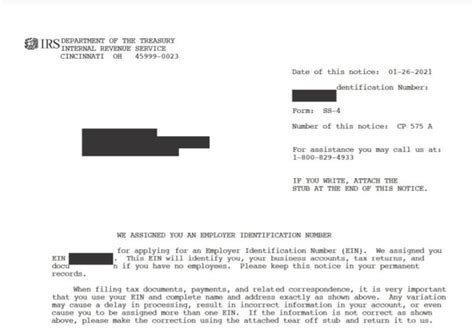

2. Review IRS Confirmation Letter

When you initially applied for your EIN, the IRS sent you a confirmation letter. This letter contains your EIN and other important information. Check your business records, both physical and digital, for this crucial document.

3. Examine Business Bank Statements and Legal Documents

Your EIN is often listed on various business documents. Take a look at:

- Business bank statements: Check your account opening documents and subsequent statements.

- Legal documents: Incorporation documents, business licenses, and other official paperwork often include your EIN.

This method requires a bit more searching but is worth the effort.

4. Access the IRS Business Account

The IRS's online portal provides a secure way to access your business tax information, including your EIN. If you've already set up an account, this is the most efficient method. You'll need your username and password to log in.

5. Contact the IRS Directly

If all else fails, you can contact the IRS directly. Be prepared to provide information that verifies your business identity. This is the last resort, as it can take time and might involve navigating through phone menus.

Tips for Preventing Future EIN Searches

- Save your confirmation letter in a secure, easily accessible location. Consider both physical and digital backups.

- Maintain organized business records: Keep all your important documents in a centralized, well-organized system.

- Set up an IRS Business Account: This simplifies access to your business tax information.

Conclusion

Locating your EIN doesn't have to be a daunting task. By systematically checking the locations outlined above, you're likely to quickly find this important number. Remember to prioritize record-keeping to avoid future searches and ensure smooth business operations. Good luck!