Understanding the WhatsApp Backup Zip File: Your Digital Safety Net

WhatsApp has become an indispensable part of our daily lives, connecting us with friends, family, and colleagues across the globe. We share countless messages, photos, videos, and documents through this platform, creating a digital archive of our personal and professional lives. But what happens if your phone is lost, stolen, or damaged? That’s where the WhatsApp backup zip file comes in – your lifeline to preserving your precious data.

This comprehensive guide will delve deep into the world of WhatsApp backup zip files, explaining what they are, how they work, and why they are crucial for protecting your digital footprint. We’ll cover everything from creating and managing backups to troubleshooting common issues and exploring advanced techniques for data recovery.

What Exactly is a WhatsApp Backup Zip File?

At its core, a WhatsApp backup zip file is a compressed archive containing all your WhatsApp data. This includes your chat history, media files (photos, videos, audio recordings), documents, profile information, and settings. The zip format allows for efficient storage and transfer of large amounts of data, making it easier to keep your backups safe and accessible.

Think of it as a digital time capsule, capturing a snapshot of your WhatsApp world at a specific moment in time. This capsule can be restored to your device, allowing you to pick up right where you left off, even if you’ve switched phones or experienced data loss.

Why are WhatsApp Backups So Important?

The importance of WhatsApp backups cannot be overstated. Here are just a few reasons why you should make them a priority:

* **Data Loss Prevention:** Accidents happen. Phones get lost, stolen, or damaged beyond repair. Without a backup, all your WhatsApp data is gone forever. A backup ensures that you can recover your chats, media, and other important information, minimizing the impact of such events.

* **Seamless Device Migration:** Upgrading to a new phone is exciting, but transferring your data can be a hassle. With a WhatsApp backup, you can easily restore your entire WhatsApp history to your new device, making the transition smooth and painless.

* **Peace of Mind:** Knowing that your WhatsApp data is securely backed up provides peace of mind. You can rest assured that your precious memories and important conversations are safe, no matter what happens to your phone.

* **Protecting Business Communications:** For many professionals, WhatsApp is a critical communication tool. Backing up your WhatsApp data can protect important business conversations, client information, and project-related files, ensuring business continuity.

Creating a WhatsApp Backup Zip File: A Step-by-Step Guide

Creating a WhatsApp backup zip file is a straightforward process, but it’s important to follow the steps carefully to ensure a successful backup. There are two primary methods for creating backups: Google Drive (for Android) and iCloud (for iOS).

Backing Up WhatsApp on Android using Google Drive

Google Drive is the default backup solution for WhatsApp on Android devices. Here’s how to create a backup:

1. **Open WhatsApp:** Launch the WhatsApp application on your Android phone.

2. **Access Settings:** Tap the three vertical dots in the top-right corner of the screen and select “Settings” from the drop-down menu.

3. **Navigate to Chats:** In the Settings menu, tap on “Chats.”

4. **Choose Chat Backup:** Select “Chat backup” from the Chats menu.

5. **Configure Backup Settings:**

* **Google Account:** Choose the Google account you want to use for backups. If you haven’t already added a Google account to your phone, you’ll be prompted to do so.

* **Backup to Google Drive:** Select the frequency of your backups (Daily, Weekly, Monthly, or Only when I tap “Back up”). Choosing a regular frequency ensures that your data is always up-to-date.

* **Include Videos:** Decide whether you want to include videos in your backups. Keep in mind that videos can significantly increase the size of your backup file.

* **Backup over:** Choose whether you want to back up over Wi-Fi or Wi-Fi and cellular. Backing up over Wi-Fi is recommended to avoid using your mobile data.

6. **Initiate Backup:** Tap the “BACK UP” button to start the backup process. The time it takes to complete the backup will depend on the size of your WhatsApp data and the speed of your internet connection.

Once the backup is complete, your WhatsApp data will be stored securely in your Google Drive account. You can access your backup files through the Google Drive app or website.

Backing Up WhatsApp on iOS using iCloud

iCloud is the default backup solution for WhatsApp on iOS devices (iPhones and iPads). Here’s how to create a backup:

1. **Open WhatsApp:** Launch the WhatsApp application on your iPhone or iPad.

2. **Access Settings:** Tap the “Settings” tab in the bottom-right corner of the screen.

3. **Navigate to Chats:** In the Settings menu, tap on “Chats.”

4. **Choose Chat Backup:** Select “Chat Backup” from the Chats menu.

5. **Configure Backup Settings:**

* **Back Up Now:** Tap the “Back Up Now” button to initiate an immediate backup. This will create a backup of your WhatsApp data and store it in your iCloud account.

* **Auto Backup:** Enable the “Auto Backup” option to schedule automatic backups. You can choose the frequency of your backups (Daily, Weekly, or Monthly).

* **Include Videos:** Decide whether you want to include videos in your backups. Keep in mind that videos can significantly increase the size of your backup file.

6. **Verify iCloud Settings:** Ensure that you are signed in to iCloud with the correct Apple ID and that you have enough storage space available in your iCloud account to accommodate your WhatsApp backup.

Once the backup is complete, your WhatsApp data will be stored securely in your iCloud account. You can manage your iCloud storage through the iPhone or iPad settings.

Accessing and Managing Your WhatsApp Backup Zip File

While WhatsApp creates backup files, these aren’t directly accessible as a standard ZIP archive through Google Drive or iCloud. The backups are stored in a proprietary format that can only be restored through the WhatsApp application itself. However, understanding where these backups reside and how to manage them is still crucial.

Locating Your WhatsApp Backup on Google Drive (Android)

Although you can’t download the WhatsApp backup as a ZIP file directly from Google Drive, you can view and manage the backup within your Google Drive settings:

1. **Open Google Drive:** Launch the Google Drive app or visit the Google Drive website (drive.google.com) on your computer.

2. **Access Settings:** Click the gear icon in the top-right corner of the screen and select “Settings.”

3. **Manage Apps:** In the Settings menu, click on “Manage apps.”

4. **Locate WhatsApp:** Scroll through the list of apps until you find “WhatsApp.”

5. **View Options:** Here, you can view the size of your WhatsApp backup and disconnect WhatsApp from your Google Drive account. Disconnecting WhatsApp will delete the backup from Google Drive, so proceed with caution.

It’s important to note that you cannot download the backup directly from Google Drive in a usable format. The backup is designed to be restored only through the WhatsApp application.

Locating Your WhatsApp Backup on iCloud (iOS)

Similarly, you can manage your WhatsApp backup within your iCloud settings:

1. **Open Settings:** On your iPhone or iPad, open the “Settings” app.

2. **Tap on Your Name:** Tap on your name at the top of the Settings menu.

3. **Select iCloud:** Tap on “iCloud.”

4. **Manage Storage:** Tap on “Manage Storage.”

5. **Locate WhatsApp:** Scroll through the list of apps until you find “WhatsApp Messenger.”

6. **View Options:** Here, you can view the size of your WhatsApp backup and delete the backup from iCloud. Deleting the backup will remove it from iCloud, so proceed with caution.

As with Google Drive, you cannot download the backup directly from iCloud in a usable format. The backup is designed to be restored only through the WhatsApp application.

Why Can’t I Directly Access the Backup as a ZIP File?

WhatsApp uses a proprietary format to store its backups for security and compatibility reasons. This format ensures that the data is protected and can only be restored by the official WhatsApp application. Allowing direct access to the backup files would create security vulnerabilities and could potentially compromise user data.

Restoring Your WhatsApp Backup: Bringing Your Data Back to Life

Restoring your WhatsApp backup is a crucial step when switching to a new phone or recovering from data loss. The restoration process is relatively straightforward, but it’s important to follow the steps carefully to ensure a successful recovery.

Restoring WhatsApp on Android from Google Drive

To restore your WhatsApp backup from Google Drive on an Android device, follow these steps:

1. **Install WhatsApp:** Download and install the latest version of WhatsApp from the Google Play Store.

2. **Verify Your Phone Number:** Launch WhatsApp and verify your phone number. Make sure you use the same phone number that you used to create the backup.

3. **Restore from Google Drive:** WhatsApp will automatically detect the existence of a backup in your Google Drive account. You will be prompted to restore your chats and media from the backup. Tap “RESTORE” to begin the restoration process.

4. **Wait for Restoration:** The restoration process may take some time, depending on the size of your backup and the speed of your internet connection. Once the restoration is complete, tap “NEXT.”

5. **Set Up Profile:** Enter your name and profile picture to complete the setup process.

Your WhatsApp chats and media will now be restored to your device. You can start using WhatsApp as you normally would.

Restoring WhatsApp on iOS from iCloud

To restore your WhatsApp backup from iCloud on an iOS device, follow these steps:

1. **Install WhatsApp:** Download and install the latest version of WhatsApp from the App Store.

2. **Verify Your Phone Number:** Launch WhatsApp and verify your phone number. Make sure you use the same phone number that you used to create the backup.

3. **Restore from iCloud:** WhatsApp will automatically detect the existence of a backup in your iCloud account. You will be prompted to restore your chats and media from the backup. Tap “Restore Chat History” to begin the restoration process.

4. **Wait for Restoration:** The restoration process may take some time, depending on the size of your backup and the speed of your internet connection. Once the restoration is complete, follow the on-screen instructions.

5. **Set Up Profile:** Enter your name and profile picture to complete the setup process.

Your WhatsApp chats and media will now be restored to your device. You can start using WhatsApp as you normally would.

Troubleshooting Common Backup and Restore Issues

While the backup and restore process is generally reliable, you may encounter some issues. Here are some common problems and their solutions:

* **Backup Not Found:**

* **Android:** Ensure that you are logged in to the correct Google account and that you have sufficient storage space in your Google Drive account.

* **iOS:** Ensure that you are signed in to iCloud with the correct Apple ID and that you have sufficient storage space in your iCloud account. Also, make sure that iCloud Drive is enabled for WhatsApp in your iCloud settings.

* **Restoration Stuck:**

* **Check Internet Connection:** Ensure that you have a stable internet connection. A weak or unstable connection can interrupt the restoration process.

* **Restart Device:** Try restarting your device and attempting the restoration again.

* **Update WhatsApp:** Make sure you are using the latest version of WhatsApp. Older versions may have compatibility issues with the backup files.

* **Insufficient Storage:**

* **Free Up Space:** Make sure you have enough storage space on your device to accommodate the restored data. Delete unnecessary files and apps to free up space.

* **Incorrect Phone Number:**

* **Verify Number:** Ensure that you are using the same phone number that you used to create the backup. You cannot restore a backup using a different phone number.

Advanced Techniques: Exploring Alternative Backup Methods

While Google Drive and iCloud are the official backup solutions for WhatsApp, there are alternative methods you can explore for more advanced control over your data.

Local Backups: Creating a Backup on Your Computer

Although WhatsApp primarily uses cloud backups, it’s possible to create local backups of your WhatsApp data on your computer. This involves connecting your phone to your computer and using third-party software to extract the data. Note that this method is not officially supported by WhatsApp and may violate their terms of service.

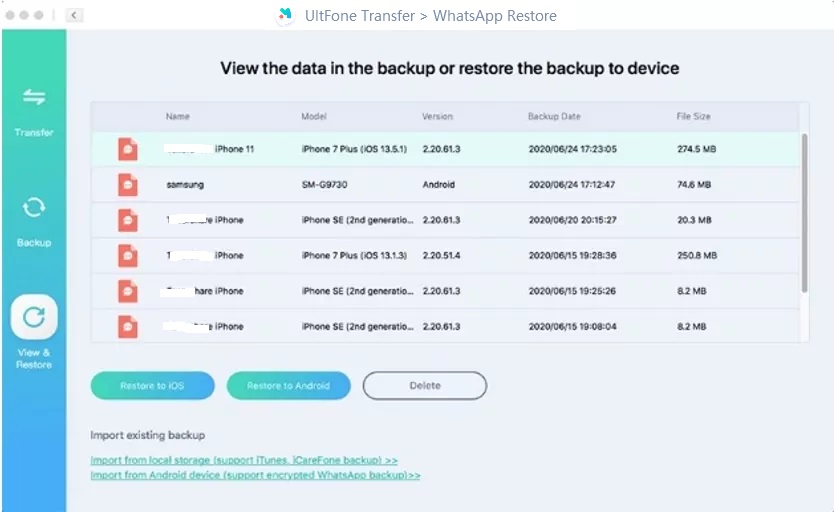

* **Using Third-Party Software:** Several third-party software tools are available that claim to extract WhatsApp data from your phone and create a local backup. However, it’s important to exercise caution when using such tools, as they may contain malware or compromise your privacy. Always research the software thoroughly and read reviews before using it.

Manual Data Transfer: Copying Media Files

While you can’t directly access the chat history as a ZIP file, you can manually copy your WhatsApp media files (photos, videos, and audio recordings) to your computer or an external storage device. This provides an additional layer of protection for your valuable media.

* **Accessing Media Folder:** On Android, the WhatsApp media files are typically stored in the “WhatsApp/Media” folder on your phone’s internal storage or SD card. On iOS, you can access the media files through the Photos app or by connecting your iPhone to your computer and using iTunes or Finder.

* **Copying Files:** Simply copy the desired media files to your computer or external storage device. You can organize the files into folders for easy access.

Protecting Your WhatsApp Backup: Security Best Practices

Your WhatsApp backup contains sensitive personal information, so it’s crucial to protect it from unauthorized access. Here are some security best practices to follow:

* **Secure Your Google Account (Android):**

* **Strong Password:** Use a strong and unique password for your Google account.

* **Two-Factor Authentication:** Enable two-factor authentication to add an extra layer of security to your account.

* **Review App Permissions:** Regularly review the apps that have access to your Google account and revoke permissions for any apps that you no longer use or trust.

* **Secure Your Apple ID (iOS):**

* **Strong Password:** Use a strong and unique password for your Apple ID.

* **Two-Factor Authentication:** Enable two-factor authentication to add an extra layer of security to your account.

* **Review App Permissions:** Regularly review the apps that have access to your Apple ID and revoke permissions for any apps that you no longer use or trust.

* **Encrypt Your Device:** Enable encryption on your phone to protect your data from unauthorized access if your device is lost or stolen.

* **Use a Strong Screen Lock:** Set a strong screen lock (PIN, password, or biometric authentication) to prevent unauthorized access to your device.

* **Be Cautious of Phishing:** Be wary of phishing emails and messages that attempt to trick you into revealing your Google or Apple ID credentials. Never click on suspicious links or provide your credentials to untrusted sources.

The Future of WhatsApp Backups: What to Expect

WhatsApp is constantly evolving, and its backup features are likely to improve in the future. Here are some potential developments to watch out for:

* **End-to-End Encryption for Backups:** Currently, WhatsApp backups stored on Google Drive and iCloud are not end-to-end encrypted. This means that Google and Apple have access to your backup data. In the future, WhatsApp may introduce end-to-end encryption for backups, providing an even higher level of security.

* **More Granular Backup Options:** WhatsApp may introduce more granular backup options, allowing you to choose which types of data to back up (e.g., chat history only, media only, or specific conversations).

* **Improved Backup Management Tools:** WhatsApp may provide more advanced backup management tools, allowing you to easily view, manage, and restore your backups from within the WhatsApp application.

* **Integration with Other Cloud Services:** WhatsApp may integrate with other cloud storage services, giving you more flexibility in choosing where to store your backups.

Conclusion: Mastering the WhatsApp Backup Zip File for Data Protection

The WhatsApp backup zip file, though not directly accessible as a traditional ZIP archive, represents a critical safety net for your digital life. By understanding the importance of backups, mastering the backup and restore process, and following security best practices, you can protect your valuable WhatsApp data from loss or unauthorized access. Whether you’re switching to a new phone, recovering from data loss, or simply seeking peace of mind, a well-managed WhatsApp backup is your key to preserving your digital memories and maintaining seamless communication.

Take the time to configure your backup settings, regularly create backups, and familiarize yourself with the restoration process. Your future self will thank you for it.