How to Apply for an Employer Identification Number (EIN)

Getting an Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a crucial step for many businesses. This guide will walk you through the process of applying for an EIN, regardless of your business structure. Understanding the requirements and completing the application correctly will ensure a smooth and efficient process.

What is an EIN?

An EIN is a unique nine-digit number assigned by the IRS to businesses operating in the United States. It's used to identify your business for tax purposes and is essential for various business activities, including:

- Opening a business bank account: Most banks require an EIN to open a business account.

- Hiring employees: You'll need an EIN to file tax returns for your employees.

- Filing business taxes: Your EIN is used on all federal tax forms for your business.

- Applying for business licenses and permits: Many states and localities require an EIN for licensing purposes.

Who Needs an EIN?

While sole proprietors without employees may be able to use their Social Security Number (SSN) for tax purposes, an EIN is generally recommended. You'll definitely need an EIN if:

- You have employees.

- You operate as a corporation or partnership.

- You have a business structure other than a single-member LLC that doesn't elect to be treated as a disregarded entity.

- You file certain tax returns, such as the excise tax returns.

How to Apply for an EIN: A Step-by-Step Guide

The quickest and easiest way to apply for an EIN is online through the IRS website. Here's how:

1. Access the IRS EIN Application:

Navigate to the IRS website and locate the online EIN application. Note: This is the recommended method for obtaining your EIN.

2. Complete the Application:

The online application is straightforward. You'll need to provide information about your business, including:

- Your business legal name: This is the exact name as it appears on your legal documents.

- Your business type: (e.g., sole proprietorship, partnership, corporation)

- Your business address: Your principal business location.

- Your contact information: This includes your phone number and email address.

- Your responsible party information: This is the individual who will be responsible for the business's tax obligations.

Important: Ensure all information is accurate and complete. Errors can delay the process.

3. Instant EIN Issuance:

Upon successful submission, your EIN will be issued immediately. You will receive your EIN immediately online and can print a confirmation for your records.

Applying by Mail (Less Recommended):

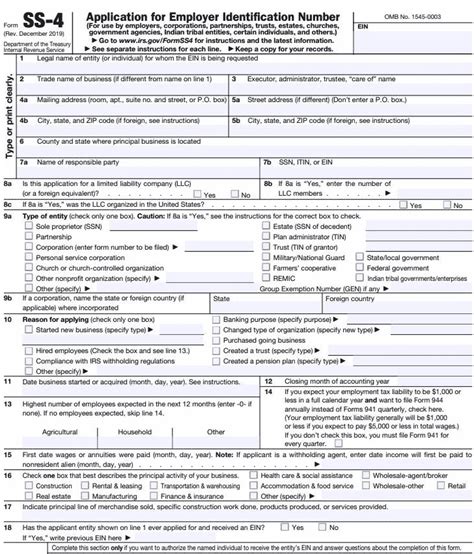

While you can apply by mail, the online application is significantly faster and more efficient. If you must apply by mail, you'll need to download Form SS-4. Instructions for completion are included on the form.

After Receiving Your EIN:

Once you receive your EIN, keep it in a safe place. You'll need it for various business transactions. Remember to keep accurate records and file your taxes promptly using your newly acquired EIN.

Key Takeaways:

- Apply online: This is the fastest and most convenient method.

- Accurate information is crucial: Double-check all details before submitting your application.

- Keep your EIN safe: This is a vital piece of information for your business.

By following these steps, you can successfully apply for your EIN and take a significant step towards building a strong foundation for your business. Remember to consult with a tax professional if you have any questions or concerns about the application process or your business tax obligations.