How to Budget: A Step-by-Step Guide to Taking Control of Your Finances

Creating a budget might seem daunting, but it's a crucial step towards financial freedom and peace of mind. This guide breaks down the process into manageable steps, empowering you to take control of your spending and achieve your financial goals.

1. Track Your Spending: Know Where Your Money Goes

Before you can create a budget, you need to understand where your money is currently going. This involves tracking your spending for at least one month, preferably two. There are several ways to do this:

- Use a budgeting app: Many free and paid apps (Mint, YNAB, Personal Capital, etc.) automatically track transactions linked to your bank accounts and credit cards.

- Spreadsheet: Create a simple spreadsheet to manually log your income and expenses. Categorize your spending (e.g., housing, transportation, food, entertainment).

- Notebook and pen: The old-fashioned way still works! Keep a notebook to record every transaction.

Pro Tip: Be honest and thorough! Even small purchases add up. The more accurate your tracking, the more effective your budget will be.

2. Calculate Your Net Income: The Foundation of Your Budget

Your net income is your income after taxes and other deductions. This is the crucial figure you'll use to build your budget. Don't use your gross income (before deductions) – it will lead to an inaccurate budget.

3. Allocate Your Income: The 50/30/20 Rule (and Variations)

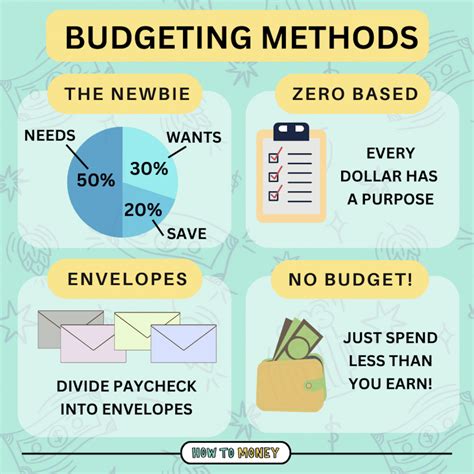

Several budgeting methods exist; the 50/30/20 rule is a popular starting point:

- 50% Needs: Allocate 50% of your net income to essential expenses like housing, utilities, groceries, transportation, and debt payments.

- 30% Wants: This portion covers non-essential expenses like dining out, entertainment, hobbies, and shopping.

- 20% Savings and Debt Repayment: Dedicate 20% to savings (emergency fund, retirement, investments) and debt repayment.

Alternative Methods: Consider other methods like the zero-based budget (allocating every dollar to a specific category) or the envelope system (cash budgeting). Experiment to find what works best for you.

4. Create Your Budget: Put Your Plan into Action

Based on your spending tracking and income calculation, allocate your income to each category. Be realistic and adjust your spending habits accordingly. If your spending exceeds your income, you'll need to identify areas to cut back.

Example Budget Categories:

- Housing: Rent or mortgage payment, property taxes, homeowner's insurance

- Transportation: Car payment, gas, insurance, public transportation

- Food: Groceries, dining out

- Utilities: Electricity, water, gas, internet

- Healthcare: Insurance premiums, medical expenses

- Debt Repayment: Credit card payments, loans

- Savings: Emergency fund, retirement, investments

- Entertainment: Movies, concerts, hobbies

- Personal Care: Haircuts, toiletries

5. Review and Adjust Your Budget Regularly

Budgeting is an ongoing process. Review your budget monthly, comparing your actual spending to your planned spending. Adjust your budget as needed to reflect changes in your income or expenses. Regular review ensures your budget remains relevant and effective.

Mastering Your Budget: Tips for Success

- Set financial goals: Having specific goals (e.g., paying off debt, saving for a down payment) will motivate you to stick to your budget.

- Automate savings: Set up automatic transfers from your checking account to your savings account.

- Cut unnecessary expenses: Identify areas where you can reduce spending without sacrificing your quality of life.

- Seek professional help: If you're struggling to create or manage a budget, consider seeking advice from a financial advisor.

By following these steps and adapting them to your unique circumstances, you can create a budget that works for you and pave the way for a more secure and prosperous financial future. Remember, consistent effort is key!